Covid-19

Bloomington’s city council now set for next step in consideration of $2M for economic relief of businesses and workers

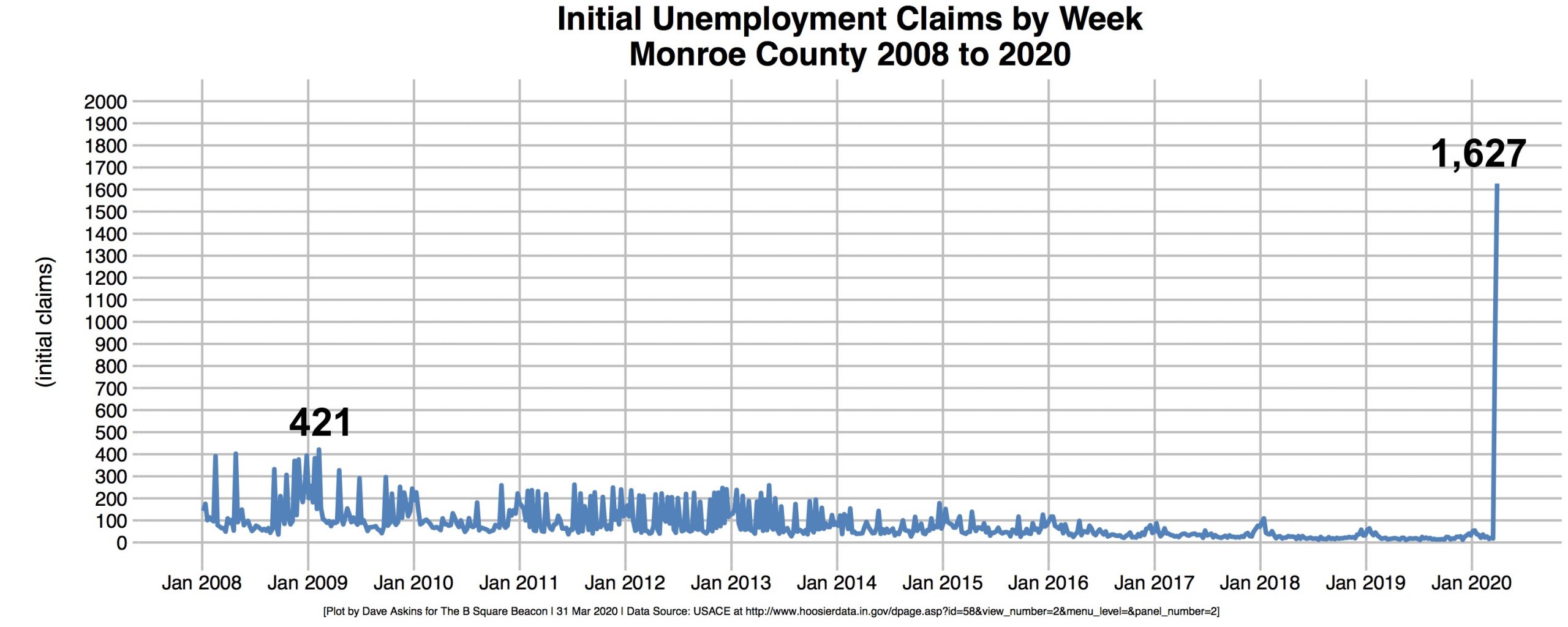

The impact of the COVID-19 pandemic on Bloomington area local businesses can now seen on charts and graphs.

The pandemic has spiked the county’s initial unemployment claims to four times the number seen during the highest week of the 2008–2009 economic downturn. Even higher numbers could be recorded next week. Unemployment numbers are released on Tuesdays.

In addition to fresh unemployment figures, this Tuesday brought a first detailed look at Bloomington’s effort to use $2 million of food and beverage tax money, as well as other funds, to provide economic relief to businesses and workers .

That’s when the Bloomington city council’s four-member sustainable development standing committee heard a report from an economic stability and recovery (ESR) working group formed by Mayor John Hamilton.

The committee met using Zoom, a videoconferencing platform, as currently allowed under a governor’s order to reduce the chance for spread of the COVID-19 virus.

A draft version of the written report will likely form the basis of the city council’s discussion on Wednesday (April 1), after the council hears a first reading of the $2-million appropriation ordinance that will allow distribution of the funds.

A final vote by the council on the appropriation is expected as soon as Tuesday next week (April 7).

Three different financial products are described in the draft document, which is expected to see further significant revisions after Wednesday’s city council meeting, according to Alex Crowley, the city’s director of economic and sustainable development.

A lingering question about the legal use of the food and beverage tax proceeds for economic relief appears now to have received a positive answer from the State Board of Accounts, in a letter dated March 31, 2020.

The food and beverage tax was enacted to pay for an expansion of the convention center, but the statute governing the tax includes a provision for economic development and tourism. The State Board of Accounts letter is not specific to food and beverage tax revenue. It appears to rest more on an emergency order issued by the governor than on a specific interpretation of the food and beverage tax statute.

Tuesday’s data release showed that the initial unemployment claims made the previous week in Monroe County nearly doubled compared to the week before, from 934 to 1,627 filings. That’s quadruple the highest number of claims in any one week dating back to the 2008–2009 downturn.

The 2008–2009 downturn was the high-water mark for such claims, going back at least to the 1960s, according to Carol Rogers, who’s co-director of the Indiana Business Research Center at IUPUI. When she spoke with The Square Beacon last week, Rogers said the impact of the 2008–2009 downturn was centered on the housing, finance, and manufacturing sectors.

Compared to the COVID-19-related unemployment filings, the downturn a dozen years ago unfolded in “slow motion,” Rogers said. And the COVID-19 pandemic is affecting different sectors of the economy. It’s businesses that Rogers describes as involving “high touch” jobs—those that involve face-to-face interactions with customers, from barbers to pre-school teachers, to restaurant workers—that are now hardest hit by COVID-19.

Severely impacted, even before the COVID-19 preventive measures were implemented under several governor’s orders, were local restaurants and drinking establishments.

Tuesday was the same day when Indiana’s governor Eric Holcomb extended his order for restaurants to remain closed to dine-in service through April 6. Now the restaurant order matches the same timespan as the governor’s stay-at-home order, which could also be extended.

The city council’s intent to appropriate some of its share of food and beverage tax money, which parallels the approach that Monroe County government is taking, comes in response to an online petition authored by Switchyard Brewing Company’s Kurtis Cummings.

The petition calls for the use of already accumulated food and beverage tax revenue to go towards relief of small independent Monroe County businesses. The petition suggests that support could come in the form of grants or zero-interest loans.

The three different financial products to be offered by the city of Bloomington—which are currently in draft form in the ESR working group’s document—to some extent fit the kind of aid requested in the petition.

A COVID-19 Small Business Bridge Loan is designed for a small business or 501(c)(3) nonprofit corporation with under 250 employees. The amounts to be lent under the draft proposal would be $1,500 to $50,000 at zero interest and an amortization period of two years, allowing for three months before the first payment is due.

Smaller amounts would be provided by a COVID-19 Micro Business Loan, designed for businesses with at least two, but fewer than 10 employees. Amounts to be lent under the draft version of this product would be $1,000 to $5,000 with zero interest and a one-year amortization period, with the possibility of deferring all payments for the entire one-year period with a balloon payment due at the end.

A third product is designed to support small businesses and nonprofits in the medium term, in the event of a prolonged pandemic, according to the draft description. A COVID-19 Blended CDFI Loan would be offered by a CDFI (Community Development Financial Institution) lender, with the city of Bloomington’s contribution coming in the form of loan loss reserves. The loss reserves would help offset risk and to encourage CDFIs or participating lenders to participate, according to the draft.

Common to all three financial products under consideration by the ESR working group are some constraints:

- Borrowers must comply with Bloomington’s living wage ordinance.

- Borrowers must be physically located within the City of Bloomington.

- Borrowers must demonstrate a significant decrease in revenue due to COVID-19. A 25-percent decrease in revenue automatically qualifies, but is not required.

- Borrowers must guarantee that funds will go to support capital expenses: including but not limited to wages, payroll costs, rent or utilities, debt service, property maintenance, and/or other immediate, essential expenses. Funds may not be distributed to equity investors or owners

Drawing a question from councilmember Matt Flaherty on Tuesday was the requirement that a borrower comply with Bloomington’s living wage ordinance. Flaherty wondered if the requirement would complicate things for restaurants, whose workers rely on tips.

The living wage ordinance has a provision for “tipped employees” which says the living wage for a tipped employee “shall be the living wage for other covered employees minus ten percent of the annual sales for the employer prorated on an hourly basis per employee.”

Crowley said that a strict reading of the ordinance would not automatically apply to businesses receiving a loan of food and beverage tax money, because that kind of money is not among the specific funds that are enumerated in the ordinance. Based on the back-and-forth between Flaherty and Crowley, it’s not settled whether conformance with the living wage ordinance will be a part of the eligibility requirements for a loan.

Flaherty also expressed some interest in finding a way to incentivize the use of loans to cover payroll expenses, so that the impact of the city’s effort would directly benefit employees, as contrasted with business owners. It’s a principle that Flaherty has been hearing a lot from constituents, he said.

Crowley said that some caution needs to be exercised when thinking about covering payroll for even a smaller organization. It would be easy to burn through the $2 million immediately, if if were used to cover payroll for every affected business, he said. It’s important to understand the federal Corona Virus Aid Relief and Economic Security (CARES) Act thoroughly, Crowley said.

The idea is to provide gap funding locally to get business across to the more robust mechanisms that could be available in the federal aid package, Crowley said.

Jen Pearl, who is CEO of the Bloomington Economic Development Corp. (BEDC), mentioned during public commentary during Tuesday’s committee meeting that part of the CARES Act is something called the Paycheck Protection Program (PPP), which provides some coverage for businesses trying to meet payroll.

An additional principle that’s included in the now-circulating draft of the ESR working group’s report is a commitment to equity:

he ESR Working Group recognizes the importance of maintaining a strong focus on equity in the execution of recommendations. It will therefore require the programs’ administrative function to develop and implement specific equity measures in its programs, thereby elevating the prioritization of underserved constituencies including minority- and women-owned businesses and businesses/individuals with disability limitations.

The Bloomington city council’s Wednesday (April 1) meeting, starting at 6:30 p.m., and subsequent committee-of-the whole discussion, will be conducted on Zoom. The public can access the meeting using the link: https://zoom.us/j/626129095

The Monroe County board of commissioners could, at its Wednesday meeting (April 1) starting at 10 a.m., give an update on its efforts to allocate $200,000 in food and beverage tax money toward economic relief. Information on how to access the Zoom conference call is available in the meeting information packet.

-

Local News2 weeks ago

Local News2 weeks ago$50,000 Truck stop sells Powerball tickets that are about to expire

-

Local News2 weeks ago

Local News2 weeks agoBehold the spectacle that is Good Gravy!

-

Indiana2 weeks ago

Indiana2 weeks agoAnderson man sentenced to 65 years for wife murder

-

Indiana2 weeks ago

Indiana2 weeks agoWoman from Aurora detained for assaulting a child

-

Local News2 weeks ago

Local News2 weeks ago$75 million “luxury urban” townhomes and condos with rooftop terraces are set to begin construction

-

Local News2 weeks ago

Local News2 weeks agoIndiana Health Department is sued by an anti-abortion group seeking access to abortion records

-

Local News1 week ago

Local News1 week ago$50,000 Powerball Double Play ticket sold in Indiana

-

Local News1 week ago

Local News1 week agoVoters choose Democrats Munson, Deckard, Henry in county council primary

Leave a Reply